Final Account || Trading Account

What is Final Account?

Final Account are the financial statements which are prepared to calculate the amount of profit earn or loss occurred during a particular time period and to give a picture of the financial position of business of that period. Those accounts and statements which are prepared at the end of a particular fiscal year with a view to determine profit and loss as well as the financial position of the organization.

Final Account are the financial statements which are prepared to calculate the amount of profit earn or loss occurred during a particular time period and to give a picture of the financial position of business of that period. Those accounts and statements which are prepared at the end of a particular fiscal year with a view to determine profit and loss as well as the financial position of the organization.

Components of Final Accounts

The components of final accounts are:

Objectives and Importance of final account:

- To ascertain the result of business operations in gross profit and gross loss, net profit and loss of the business during the year.

- To present the true financial position of the business on a particular date.

- To help in making different managerial decisions.

Trading Account

The trading account is the first step of final account prepared at the end of financial year to ascertain gross profit or gross loss.

Objectives of preparing Trading Account

- To know the gross profit and gross loss made by the business during the particular period.

- To provide information about opening and closing stock for making purchasing plans and policies.

- To provide information about the direct expenses and factory expenses to make comparison.

Importance of Trading Account:

- It helps to provide information regarding closing stock, sales and cost of goods sold.

- It shows the relationship between gross profit and sales which helps to measure profitability position of the business.

- It helps to provide information to prepare future plans and policies.

- It helps to determine the price of goods and services.

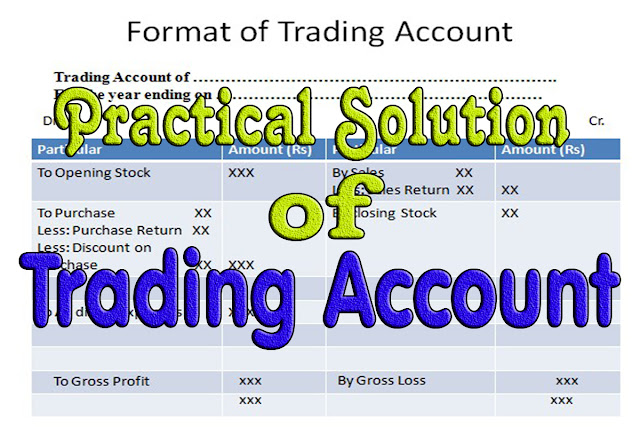

Preparation of Trading Account

It is a nominal account having debit and credit side in which all the direct expenses and manufacturing expenses are shown in debit side and

all direct incomes i.e. sales and closing stock are shown in credit side of the Trading account.

| Items Recorded in Debit | Items Recorded in Credit Side |

|

|

Example1: From the following information prepare Trading Account for the year ending on 31st Chaitra 2069.

| Particular | Amount | Particular | Amount |

| Opening Stock | 75,000 | Sales | 6,30,000 |

| Return outwards | 5,000 | Wages | 2,000 |

| Carriage inwards | 1,000 | Purchases | 5,25,000 |

| Return Inwards | 10,000 | Closing stock | 42,000 |

Solution:

| Trading Account of ABC Fo the year ending 31st Chaitra 2069 Dr. Cr. | |||

| Particular | Amount | Particular | Amount |

| To Opening Stock | 75,000 | By Sales ................. 6,30,000 Less: Return Inwards: 10,000 |

6,20,000 |

| To Purchase ............ 5,25,000 Less: Return outwards: 5,000 |

5,20,000 | By Closing stock | 42,000 |

| To wages | 2,000 | ||

| To Carriage inwards | 1,000 | ||

| To gross profit | 64,000 | ||

| 6,62,000 | 6,62,000 | ||

Informative read! Your insights on 'Final Account || Trading Account' provide clarity on essential financial aspects. Thanks for the valuable information! If you're interested in details on demo stock trading account, feel free to explore more.

Reply