Profit and Loss Account:

Profit and Loss account is prepared to ascertaining the net profit earned or net loss suffered by a business during an accounting period.

Profit and loss account is a statement which summarizes all indirect revenue expenses in one side which is compared with gross profit/revenue

income in another side and net trading income of an accounting period is assessed.” - By S.Mukharjee

Objectives of preparing P/L Account

- To know the net profit and net loss made by the business during the particular period.

- To provide information about indirect expenses i.e. office and administrative, selling and distribution, financial expenses and other expenses and losses.

- To provide information about different sources of indirect income and gain.

- To provide information about the profitability of a business.

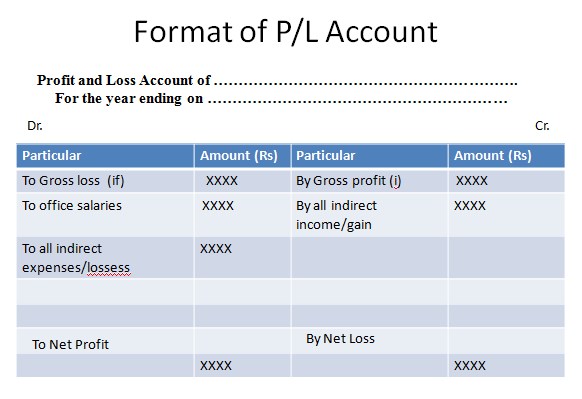

Preparation of P/L Account

All the indirect expenses and losses are recorded in debit side and all the indirect incomes and gains are recorded in Credit side of P/L Account.

| Items Recorded in Debit | Items Recorded in Credit Side |

|

|

Example1: The following information’s are provided to you of Himal Co. Ltd as on 31 Dec. 2017.

| Particular | Amount | Particular | Amount |

| Salaries | 18,000 | Insurance Premium | 8,000 |

| Sundry expenses | 4,000 | Discount Received | 4,000 |

| Provision of bad debts | 12,000 | Commission paid | 4,400 |

| Bad debt | 4,600 | Rent received | 2,000 |

| Discount allowed | 3,200 | Advertisement | 9,000 |

| Gross profit | 68,400 | Depreciation | 520 |

Solution:

| Profit and Loss Account of Himal Co. Ltd Fo the year ending 31st Dec. 2017 | |||

| Particular | Amount | Particular | Amount |

| To Salaries | 18,000 | By Gross profit b/d | 68,400 |

| To Insurance premium | 8,000 | By Discount received | 4,000 |

| To Sundry expenses | 4,000 | By Rent received | 2,000 |

| To Provision for bad debts | 12,000 | ||

| To Commission paid | 4,400 | ||

| To Bad debts | 4,600 | ||

| To Discount allowed | 3,200 | ||

| To Advertisement | 9,000 | ||

| To Depreciation | 520 | ||

| To Net Profit c/d | 10,680 | ||

| 74,400 | 74,400 | ||

Example1:

Prepare Profit and Loss account of Hetauda Company Pvt. Ltd. For the fiscal year end of Ashadh 2067/068 according to the following transaction.

| Particular | Amount | Particular | Amount |

| Gross profit | 1,85,000 | Salary | 81,000 |

| Profit in investment | 11,000 | Tax | 7,000 |

| Commission received | 4,000 | Interest paid | 20,000 |

| Advertisement | 4,000 | Interest paid | 20,000 |

Solution:

| Profit and Loss Account of Hetauda Company Pvt. Ltd. Fo the fiscal year end of 31st Ashadh. 2068 | |||

| Particular | Amount | Particular | Amount |

| To Salary | 81,000 | By Gross profit b/d | 1,85,000 |

| To Tax | 7,000 | By profit in investment | 11,000 |

| To Interest paid | 20,000 | By Commission received | 4,000 |

| To Advertisement | 15,000 | ||

| To Audit Fees | 10,00 | ||

| To Net Profit | 67,0000 | ||

| 2,00,000 | 2,00,000 | ||

Amazing article! I enjoyed reading it a lot. Thanks for sharing such interesting information. Nowadays, as the business are growing so the debts. To manage your account receivables you mush approach an international global collection agency.

Reply